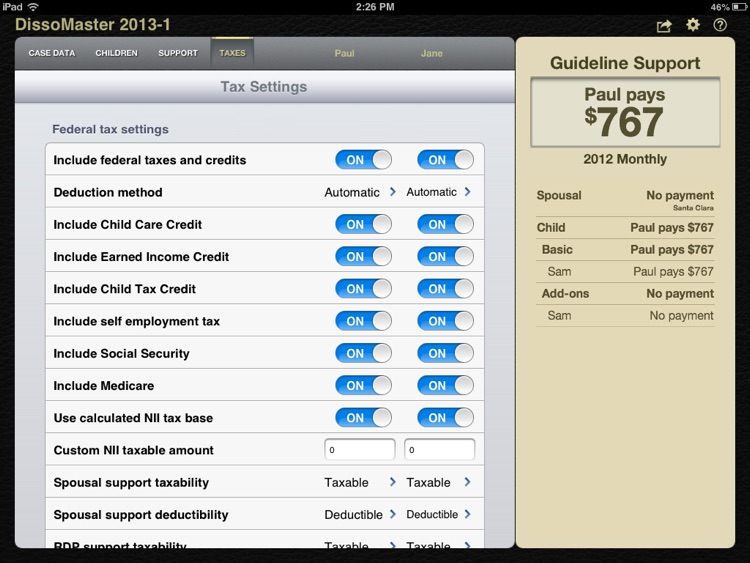

The “DissoMaster” is a program used by Los Angeles Superior Court, and many other courts, as well as the majority of family law attorneys to calculate child and spousal support. The DissoMaster computes child and/or spousal support based on the income of the parties, the timeshare with the children, and a variety of expenses and tax.

- Child Support Calculator

- Dissomaster Spousal Support California

- Dissomaster

- Dissomaster Program

- Dissomaster California Calculator

- Dissomaster Report

What Is a DissoMaster Report?

The DissoMaster™ program has been used for over two decades to determine guideline child and spousal support payments. Our company has over 17 years of experience using the DissoMaster™ program and we can put that knowledge toward finding the best support payment for you. DissoMaster software is used by family law professionals in California to calculate child support and spousal support payments in divorce cases. The Superior Court of California has relied on DissoMaster in divorce cases for more than two decades.

Child Support Calculator

DissoMaster software is used by family law professionals in California to calculate child support and spousal support payments in divorce cases. The Superior Court of California has relied on DissoMaster in divorce cases for more than two decades. It is one of several computer programs certified by the California Judicial Council used to calculate family support obligations.

Parts of Your DissoMaster Report

California courts print out DissoMaster reports for family support obligations. A DissoMaster report will typically have three columns of information on a page.

The first column is further subdivided into three more columns with the following labels:

- Input Data: This column describes the category to which the values of the other two subcolumns apply. These categories relate to income information as divided into monthly amounts.

- Father: This column appears to the right of the input data column. It contains values for the input data category as they apply to the father.

- Mother: This column appears to the right of the father column. It contains values for the input data category as applied to the mother.

The second column shows you the guideline support figures calculated from the income information of the first column. This column is subdivided into three subsections:

- Nets (adjusted): This section relates to the adjusted net income for each party individually and the total income for both parties.

- Support: This section shows you the child support amounts the payor spouse is obligated to pay. The figure is broken down into different items, but the line that says “total” is the figure the supporting spouse should worry about. This figure is calculated based on California statutory guidelines.

- Proposed tactic [number]: This is an alternative method of calculating support based on the settings used in the DissoMaster program. The total proposed amount of the support obligation may differ from the amount of guideline support.

Dissomaster Spousal Support California

Applicable Deductions

In the input data subcolumn of the first column, you can find lines that relate to deductions toward the bottom. Similar to how deductions work when filing your income tax return, these figures are important as they can reduce your support obligation to an amount that is easier to pay.

If applicable, it is important for you to check if the relevant deductions were applied to calculate your support obligation, including:

- Health Insurance: This amount includes health insurance premiums and other costs and is deductible from your income.

- Itemized Deductions: These costs can help bring your support obligation down if they apply. In particular, costs for property taxes and deductible interest expenses should be included and deducted from your income for purposes of calculating guideline support in California.

- Required Union Dues: Union dues may be deducted from your income to lower your support obligations.

- Mandatory Retirement: Contributions to a government retirement plan are deductible from your income for purposes of calculating support. Government employees are typically required to make large contributions to these plans, so deducting those contributions can really help make your support obligation reflect your financial reality more accurately.

Quality Legal Advice for Orange County Families

Do you need a tenacious advocate you can count on to effectively advocate for you and your family’s best interests? If so, you should get in touch with a skilled attorney at Moshtael Family Law. Our legal team is committed to serving families in Orange County and throughout the Southern California area. We provide personalized legal representation that focuses on the unique circumstances of your case to help preserve your legal rights.

For more information about how Moshtael Family Law can assist you, call our office at (714) 909-2561 or visit us online to set up an initial consultation today.

Use DissoMaster and Custody X Change together

Get the most accurate child support amounts when you combine Custody X Change with DissoMaster.

When DissoMaster asks you for total parenting time, don't rely on guesswork or estimates.

Instead, use Custody X Change to calculate total parenting time numbers from any custody schedule.

Enter those numbers into the appropriate field in the DissoMaster program for an accurate and fair child support amount based on California's guidelines.

Custody X Change calculates parenting time percentages. Use it together with Dissomaster to have more accurate child support calculations.

DissoMaster calculates complex family law formulas

For more than 20 years, DissoMaster software has helped family law professionals with calculating complex formulas. Its goal is to reduce the time it takes for you to extract accurate numbers from the raw data of each case.

Once you enter the information from each case into the appropriate fields, DissoMaster organizes it and calculates appropriate amounts using the most up-to-date California formulas and guidelines.

DissoMaster gives you the ability to accurately calculate a range of data, including:

- Child support

- Spousal support

- Asset division

- Debt division

- Arrearage

You can feel confident that DissoMaster software contains the latest state and federal formulas because the program is updated on an as-needed basis throughout the year. Whenever support or other calculations change, you'll receive software notification updates.

For example, if the California state legislature makes amendments to statues that affect the child support formula, you'll receive a CD-ROM with an updated version of the software. You also have the option to download updates from the website.

DissoMaster also works with its companion software programs called Executioner and Propertizer. Customers can purchase each program individually or the DissoMaster Suite, which contains all three programs on one CD-ROM.

The California Judicial Council approves DissoMaster support calculation software, and it is used extensively in courts throughout the state.

Benefits of the DissoMaster suite

DissoMaster strives to provide an easy-to-use software program that gives you reliable and accurate support calculations for family law cases, whether simple or complicated.

DissoMaster software makes certain tasks and calculations easier:

- Figures child and spousal support

- Calculates gross income to net income

- Shows multiple settlement scenarios

- Displays several cases at once

DissoMaster's companion software, Propertizer, makes calculations necessary to fairly and accurately divide marital assets and debts. It can assign property to one party alone or divide between two. The after-tax calculations are invaluable for family law cases and are updated with the latest guidelines.

Executioner software, another companion program, calculates arrears based on a series of requested and actual child support and spousal support payments. It figures late or missed payments, adds interest and penalties, and even provides reports and court documents based on the data.

DissoMaster software is reviewed each year by a firm of certified public accountants to ensure the formulas are accurate. This attention to detail helps keep DissoMaster as one of the premium support software programs in California.

DissoMaster also gives you free technical support, online training, phone coaching, annual updated CDs, and email notifications and alerts.

DissoMaster requires parenting time totals

DissoMaster software requires a timeshare percentage for the noncustodial parent in order to figure out child support, based on the guidelines set by the state of California.

Dissomaster

Parenting time is the total time each parent spends with their children outside of school or day care. To figure out a correct timeshare percentage for California, you must calculate the amount of time the nonresidential parent spends with the children.

This information is combined with data concerning each parent's income and the parenting time credit applies to both sole and shared physical custody cases.

DissoMaster lets you enter a percentage in order to calculate child support. California guidelines allow for a variety of schedules with many different time factors. When clients choose a detailed visitation schedule, it becomes very difficult to calculate a precise timeshare percentage.

Custody X Change calculates parenting time totals

Custody X Change software includes a parenting time calculator that shows exactly how much time each parent has with the children.

When you set up a parenting time schedule, the software automatically counts up all the hours for the nonresidential parent. This accurate parenting time total gives you the precise data you need.

Dissomaster Program

Use Custody X Change to get accurate parenting time totals, because:

Dissomaster California Calculator

- Parenting time totals are difficult to figure out by hand, because attorneys must add all the quarter, half and full days within a year for the nonresidential parent.

- Figuring parenting time totals adjust every time an attorney changes the schedule

- Calculating and re-calculating any change to the schedule is so complex, some attorneys are forced to estimate or guess.

- Entering parenting time totals calculated from a guess or estimate into the California child support formula means that child support amounts will likely be wrong.

Dissomaster Report

Custody X Change calculates parenting time percentages. Use it together with Dissomaster to have more accurate child support calculations.